He writes:

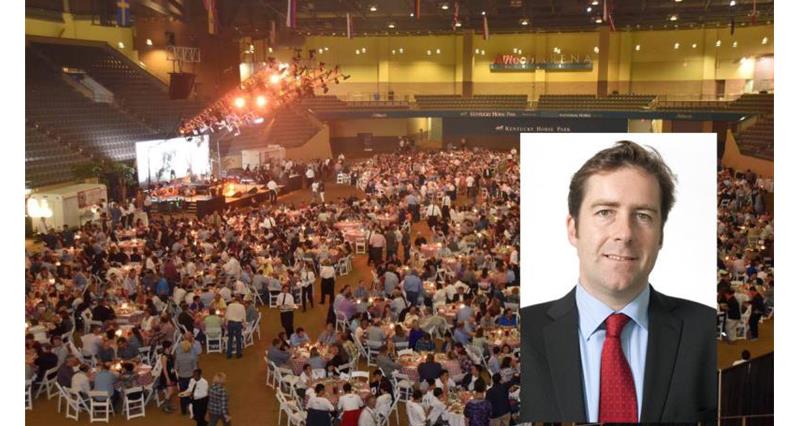

Attend a farming conference in the UK right now, and chances are that low prices, the EU Referendum and general uncertainty will shape the views and mood of the delegates. Heading to a conference on a different continent, I was struck by the different take on issues and opportunities.

Although low agricultural prices are a global characteristic, the long term optimism of businesses in agriculture and food was very much to the fore. My take is there were two key reasons for this, a growing market and the ability to apply evolving technology.

Population growth continues apace. Between now and 2030, there is a forecast 35% increase in the global middle classes. Global economic woes have slowed down demand for now, but the trend will be for more food. Not only that, but the urbanisation of the world’s population means that there will be fewer farmers to produce the food we need.

Shifting economic fortunes means that the power is also shifting away from traditional economies. By 2050, the E7 (China, India, Brazil, Russia, Indonesia, Mexico and Turkey) will collectively have economies that are double the size of the G7 (Canada, France, Germany, Italy, Japan, the United Kingdom, and the United States). We will see more trade, and expect to see more food transported from regions where it can be produced to parts of the world where consumers will be.

From a technology perspective, delegates were told that all companies will be technology companies to one extent or another in the future, including agriculture. Few outside of farming consider us a high-tech sector, but uptake of tech like GPS or robotic milking increasingly confounds this view.

And it no longer needs a crystal ball to look at what’s coming next; increasingly sophisticated robotics to replace labour, more and more visual-imaging technology, widespread use of drones and remote vehicles. There are also the opportunities that improved data and analytics give to farmers.

Better data means better decisions. In turn, that means improved productivity. Technology means our shoppers will be increasingly connected too, whether it’s checking where food comes from or your fridge automatically placing your shopping order as you use up products.

Reflecting on this whistle-stop trip to the US with colleagues a couple of weeks later, I’m pretty clear that regardless of whether we’re in or out of Europe, we need to be targeting our efforts to develop export markets.

I’m also wary of what the current low prices and business uncertainty might mean for UK farmers vis a vis their competitors – are farmers in other countries investing in the technology and know-how that we’re missing out on?

Plus, I still have a nagging doubt that we face one or two barriers to applying some of this emerging technology, particularly given that rural parts of the UK are still facing considerable connectivity issues.

Nonetheless, the world is changing. And as new investors are coming into agriculture, they bring new capabilities, continually raise expectations and are changing our industry.

Phil's take home points:

- Today’s expectations are tomorrow’s minimum standards.

- The food and drink category has seen lots of merger and acquisition activity (71 megadeals totalling $129billion in 2015) as the agri-food sector consolidates. How is this changing your business?

- Energy prices will get cheaper due to innovation - battery prices have fallen by 80% in the last 5 years and solar output has grown 100 fold in the last 13 years.

- No matter where you are in the world or who you are selling to, you have to do the right thing in terms of sustainability and the environment – you can’t pick and choose, and there are no short cuts.

More of our expert blogs...

- The long road to mandatory origin labelling, insight from Lorna Hegenbarth

- Farm visits reconnect children with their food, writes Mark Pope

- The WFU may be gone, but its message is more important than ever, says NFU Deputy President Minette Batters

- GM foods are safe, writes the NFU's chief science adviser Dr Helen Ferrier

- Ambitious plans for Digital Economy Bill by Suzanne Clear, our senior adviser on planning and rural affairs