The COVID-19 pandemic can be described in economic terms as a Black Swan event. These events are characterized by their extreme rarity, unpredictability and their severe if not catastrophic impact.

The 2008 financial crisis is another example of this kind of phenomenon, although some would say that was predictable in hindsight. As over 20% of the world’s population are now under some kind of lockdown, the economic impact of Covid 19 is clearly evident.

The latest predictions are for a significant contraction in global growth, with many economists predicting a recession on the scale of the 1930s Great Depression. Supply chains are already hugely disrupted with a 25% reduction in global shipping. The Office for Budget Responsibility this week predicted the UK economy could shrink by up to 35% this spring (and by up to 13% as a whole for 2020), with 3.4m unemployed as a result by the end of June. In the US, 20 million Americans could lose their jobs.

The International Monetary Fund (IMF) is predicting a global contraction of more than 3% this year. Even Asia won’t see any growth this year – the first time in nearly 60 years.

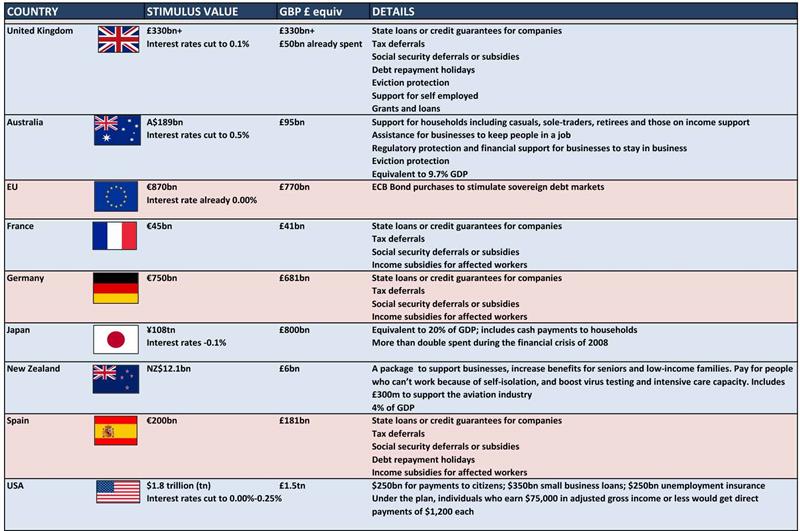

Below: Measures by country (open larger images here or click / tap image)

As the table above shows, governments around the world have been attempting to mitigate the impact of COVID-19 on their economies by providing stimulus measures. In some instances the levels far exceed that given in the bailouts of the 2008 financial crisis.

The UK for example has announced a £330bn package of support to businesses through loans and support to employees and the self-employed unable to work due to the pandemic. Interest rates have been cut to record lows of 0.1%. The US alone has provided support to the value of $1.8trillion, and Japan has initiated a stimulus package worth 20% of its annual Gross Domestic Product.

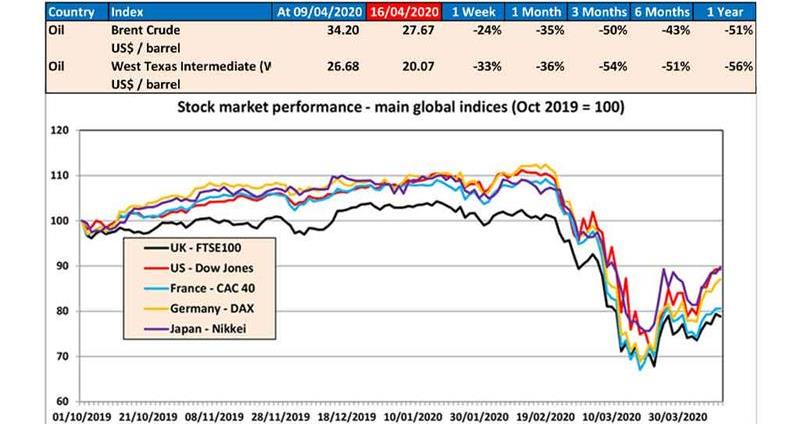

One cannot ignore the financial markets. The bull run of stock price increases which began in 2009 is now well and truly over. Global stock markets reached their lows in mid- March, with reductions of around 40% from their February highs. Global indices have recovered somewhat since then as the graph below shows, although the London market (FTSE100) is lagging behind due to its high proportion of oil and banking stocks, which have been hit hard by the pandemic.

Crude oil (first table below) has lost 60% of its value since last year due to the fall in demand due to less travel and manufacturing. An agreement by OPEC to cut production has stabilised the oil price to some degree, although some even predict US prices could turn negative in some areas as producers pay to take excess crude off their hands.

However, the world economy is expected to bounce back from a severe, yet short, impact following the coronavirus pandemic. The rationale is that the economy before the coronavirus was in great shape. In all likelihood the recovery will be long and slow. The OBR believes the UK economy is expected to get back to its pre-crisis growth trend by the end of 2020. China is expected to grow by 9.2% in 2021 and the International Monetary Fund predicts a 5.8% rebound of global growth in 2021.