He writes:

One of the regular features of the Weekly Intelligence update that I publish every Friday is the topic of inflation – or the rise in the prices of goods and services over time.

Each month the Office for National Statistics release these figures and I report on them in the update. Why is the rate of inflation important? It is because it affects everyone’s purchasing power. When inflation is higher than the rate of wage growth (a situation we are seeing in 2017) we are in real terms seeing a reduction in our purchasing power. When inflation is lower than wage growth, the pound in our pocket will effectively go further and over time we see a rise in living standards.

High levels of inflation (like that seen in the 1970s and 1980s) is generally seen as being bad for the economy as it quickly erodes what money can buy. The level of inflation is generally controlled by raising or lowering interest rates. While flat or low inflation can be good news for consumers, a prolonged period of negative inflation is also harmful to an economy - the fear is that people will stop spending in the hope that goods or services will become cheaper later thereby slowing growth.

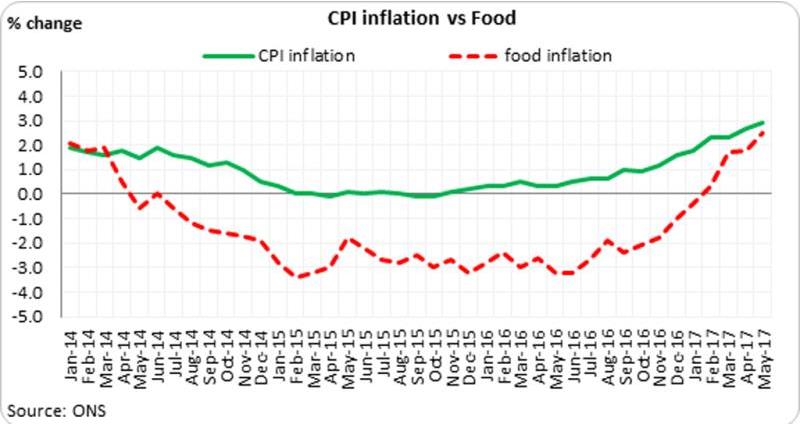

So what has been happening to inflation over the last few years? Looking at the graph below, and going back to January 2014, the main measure of inflation, Consumer Prices Index (CPI) stood at 2.1% and food inflation was 1.9%, in line with The Bank of England’s 2% inflation target.

Then in the summer of 2014 things started changing. We saw food price deflation, where food prices began to fall compared with a year earlier. One of the reasons cited for this was the fight for market share between leading supermarkets putting pressure on their prices. In fact, the consumer experienced an unprecedented 31 consecutive months of annual food price deflation until January 2017.

Then in the summer of 2014 things started changing. We saw food price deflation, where food prices began to fall compared with a year earlier. One of the reasons cited for this was the fight for market share between leading supermarkets putting pressure on their prices. In fact, the consumer experienced an unprecedented 31 consecutive months of annual food price deflation until January 2017.

Alongside food price inflation, the CPI figure hit 0.0% in February 2015, meaning that the cost of living was the same as it was a year earlier and remained around this figure or in fact marginally lower (deflation) until the end of the year. It actually turned negative in April 2015, for the first time since 1960, mainly as a result of falling fuel prices and as mentioned lower food prices.

In June 2016, the UK voted to leave the European Union. This resulted in the value of the pound falling dramatically against the other main currencies including the US Dollar and Euro. So what has this got to do with inflation you may ask? A weaker exchange rate boosts exports but also makes imported goods more expensive, which businesses which eventually pass on to consumers in the form of higher prices. And so we have seen since the later part of 2016 prices starting to edge up, with overall inflation currently at its highest point since June 2013.