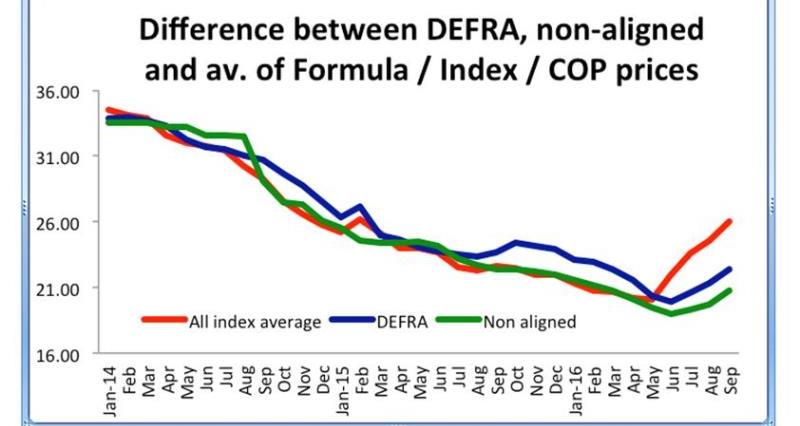

To add some meat onto the bone – when you plot the average of all of the farmgate price indicators that reflect or influence the UK market (AMPE, MCVE, UFU index, the Dairy Crest Formula, Tesco and Sainsburys COP prices and the EU milk price (denoted by the Arla price and the Ornua PPI index) and compare it to the Defra farmgate published price and an average of non-aligned prices the three lines track extremely close. That is until May 2016. From then, though, the all index average price increases exponentially, while milk prices clearly do not.

Dairy analyst Chris Walkland has been doing the sums. The gap between UK farm prices and commodity prices is widening as we speak. Most forward price indicators (AMPE, MCVE, Futures, GDT etc) are showing prices should be between 25ppl and 30ppl at the moment. Yet most non-aligned prices are still at or around 20ppl. The July Defra average milk price, which included aligned prices was only 20.57ppl. To delve into the detail August’s AMPE (Actual Milk Price Equivalent) is calculated at 26ppl and the MCVE (Milk for Cheese equivalent) was 28ppl. We all know that markets have strengthened again since then.

AHDB Dairy’s latest Forward Market Performance (FMP) indicator also paints a positive position for the supply/demand balance for the rest of the year. Even with the wholesale price increases over the past month, processors that trade on futures still believe demand will outstrip supply for the remainder of 2016. We’ve seen quotes for spot milk at over 40ppl, with futures prices hitting 50ppl.

If the average index price (above) is taken from January 2014 to May 2016, multiplied against the monthly milk volumes and then compared to the DEFRA price, there is just a 3% difference between the two. i.e if the all index average price can be seen as representing the price that dairy farmers should have received for their milk, and the DEFRA price represents what they were actually paid, then there is a miniscule difference between the two between this time frame.

Since June though this deferential is now 13.6%. The differential between what farmers should have got (on this basis), and what they actually did get, is down £130 million since June. Taking out the EU linked price (Arla) the differential is more like £156m. And then taking out both Arla and Ornua it’s £200 million.

Clearly milk buyers should be concerned as to where their future milk supply will come from. That’s why this week we’ve seen Dale Farm Northern Ireland encourage more milk supply for the next three months. Any extra litres supplied to the co-operative will receive an extra 4ppl on top of a 2ppl winter premium.

Our message is clear – until milk buyers start paying fair, sustainable milk prices, volumes will not recover. Farmers have been patient, understanding the time lag that is part of dairy trade. That said, that reason is starting to wear thin, as we need to start considering increased costs of winter housing and feeding.