This budget will be the first for the new government and will be their chance to set out their financial priorities for the next parliament.

The budget will outline the government’s economic strategy and present detailed tax and spending plans for the upcoming financial year. It is a blueprint for how the government intends to raise revenue (through taxes and other means) and how it plans to allocate spending across various sectors and government departments including those relevant to farming such as Defra and the Department for Business and Trade.

It provides crucial insights into the government’s financial plans, priorities, and economic forecasts for the year ahead.

Practical policies

The previous Chancellor, Jeremy Hunt, delivered the last Budget in spring, which saw some welcome assurances on agricultural property relief and devolved funding for rural areas, but also faced criticism from the NFU on the removal of tax reliefs for FHLs (Furnished Holiday Lettings).

New chancellor Rachel Reeves will deliver the budget on 30 October after which MPs will spend several days debating the plans before being asked to approve the proposals.

“It has been reassuring to hear the new government recognise that food security is national security,” wrote NFU President Tom Bradshaw in his letter to the Chancellor.

The NFU President said he was “heartened” to hear the Prime Minister’s words when he delivered a keynote speech at the NFU’s Conference last year, saying that a Labour government would “seek a new relationship with the countryside and farming communities on this basis”.

“What farmers, growers and the public now need to see are practical policies that deliver on this shared mission,” Tom added.

7 key asks

1. The agriculture budget

The agriculture budget in the previous parliament was £3.1 billion a year. HMT now need to be clear that the food security, climate change and environmental challenges we face need to be matched by a renewed and improved financial budget.

This isn't just the view of the NFU, it is also the view of environmental NGOs, highlighting cross-sector consensus on the urgent need for a ring-fenced agriculture budget.

It is worth emphasising that, rather than 'money for farmers', this is about safeguarding our food security and our farmed environment. It is funding that will give farmers the confidence to invest for the future and help make the government's aims around sustainable food production, affordability of food, energy security, the environment and net zero possible.

The NFU commissioned The Andersons Centre to model the public funding required to deliver the government’s ambitions for agriculture in England over the 2025 to 2030 period, structured around our three agricultural policy cornerstones.

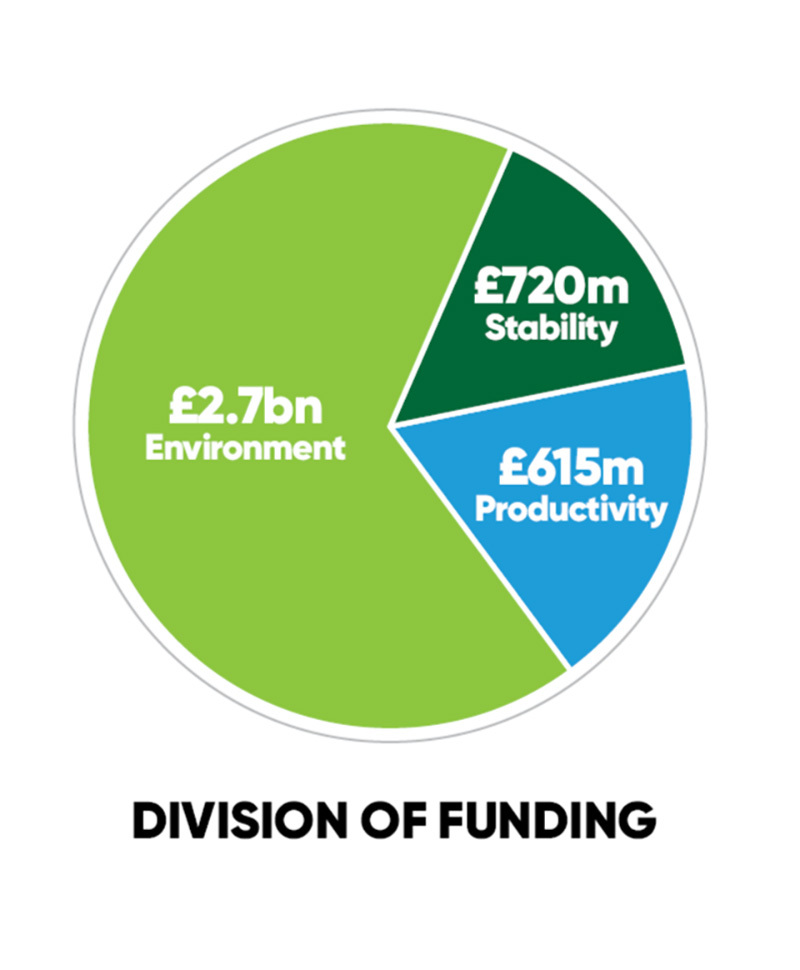

The research indicates that an annual agricultural budget for England of around £4 billion would support the delivery of a balanced agricultural policy which underpins global competitiveness:

- around £2.7 billion to meet the government’s environmental goals

- £615 million for driving productivity

- £720 million to support the economic stability of agricultural businesses

Respecting the nature of devolved government, we estimate this would translate to a UK-wide budget of around £5.6 billion.

2. Clarity on APR

We are seeking confirmation that there will be no changes to APR (Agricultural Property Relief) which currently exempts farmland from inheritance tax.

The NFU believes that any removal of APR is unlikely to raise much in the way of tax, but could lead to a contraction in the amount of rental land for farmers.

This would then have a wider impact on food security if landowners were to remove their land from tenancies and from food production.

In the past, the NFU has been reassured to hear the new Defra Secretary confirm the party had no plans to change inheritance tax including Agricultural Property Relief.

3. FHL tax change

We are calling for a full consultation ahead of the proposed abolition of the FHL (Furnished Holiday Lettings) regime which comes into effect in April 2025.

Announced by the previous government, the change to the taxation of FHLs was done in a bid to increase the properties available for more permanent rental.

The NFU strongly opposed similar plans in 2009 and will do so again, with the FHL regime seen as an important source of diversification for farm businesses.

4. Resourcing

The NFU is calling on the government to ensure there is adequate departmental resourcing in place to deliver Defra's Farming and Countryside Programme, maintain flood defences, and deliver the government's new strategy to eradicate bovine TB.

5. Capital allowances to incentivise investment

We are asking for the introduction of capital allowances, for both incorporated and unincorporated businesses, to incentivise the investment required in a broad range of climate smart capital investments.

6. CGT rates

If CGT (Capital Gains Tax) rates are to be increased or aligned to income tax, they should only be applied to non-business or short-term gains.

7. Rural prosperity fund

We are asking for confirmation of a further round of the REPF (Rural England Prosperity Fund).

The fund is a replacement for EU structural funds such as LEADER and the Growth Programme.

Policies to revitalise farm business confidence

Looking ahead to the Budget, Tom concluded: “I seriously hope the Chancellor will consider announcing these policies at the Autumn Budget to give farmers across the country the security and confidence to be able to plan for the future and grow their businesses.

“The UK’s farmers are ambitious for the future, and with policies that revitalise farm business confidence, the government can kickstart economic growth, deliver affordable, climate friendly, high welfare food production, improve the environment and stimulate clean energy supply.

“I truly believe we can deliver these shared ambitions, as long as the government works hand in hand with the agriculture industry to achieve this.”

How is the Budget produced?

The creation of the Autumn Budget is a collaborative process that involves various government departments, agencies, and consultations with independent bodies.

The Treasury, led by the Chancellor of the Exchequer, is responsible for the overall production of the Budget. Treasury officials assess current economic conditions, forecasts for growth, and the state of public finances. They also consult with key government departments and public sector bodies.

The OBR (Office for Budget Responsibility) plays a crucial role by providing independent economic forecasts and assessments of the public finances. It ensures that the government's Budget plans are based on realistic economic expectations.

Individual departments submit their funding needs and spending plans to the Treasury and the NFU has been making representations across government on the importance of a budget that delivers for a resilient, competitive and sustainable agriculture sector.

The UK government’s Autumn Budget is more than just a financial statement – it’s a comprehensive plan that sets the course for the nation’s economy. For businesses, families, and individuals across the UK, the Budget shapes everything from household finances to national economic health. This is why it remains one of the most closely watched political and financial events of the year.