“We have spent the past 14 months campaigning and lobbying to try and mitigate the worst of the impacts of the proposals,” said NFU President Tom Bradshaw.

“After it became clear that this policy wasn’t going anywhere, we have focused our campaign to mitigate the worst of its impacts for the majority.

“Today’s announcement, which sees the tax threshold raised from £1m to £2.5m, will come as a huge relief to many. While there is still tax to pay, this will greatly reduce that tax burden for many family farms, those working people of the countryside.”

“I am immensely proud of all those farmers and growers who have worked with the NFU and supported our campaign.”

NFU President Tom Bradshaw

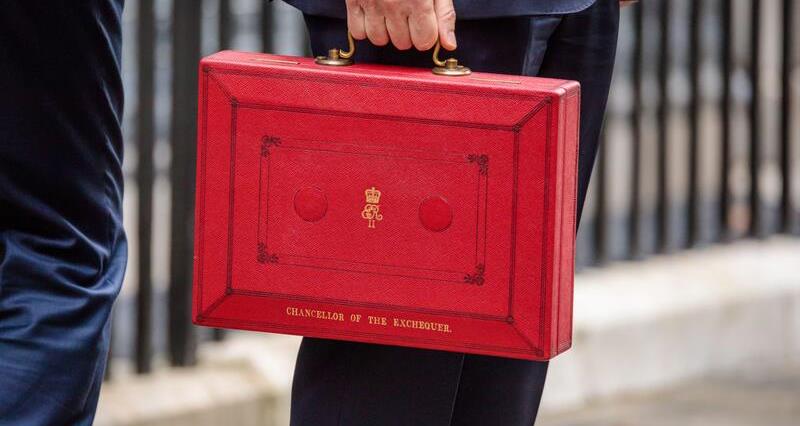

The government’s proposals to change the rules for APR and BPR (agricultural property relief and business property relief) are due to come into force in April 2026 and would have seen an effective tax rate of 20% on agricultural assets valued over £1 million.

Today’s announcement sees that threshold raised to £2.5 million. This is on top of the change to the spousal transfer allowance, announced by the Chancellor at the most recent Autumn Budget, which will allow those farmers who are married, or have deceased spouses or civil partners, to transfer their inheritance tax allowance to one another if one of them dies having not used their allowance, meaning they will be able to pass on up to £5 million in qualifying agricultural or business assets between them.

The change will be introduced through an amendment to the Finance Bill, with 50% relief continuing to apply to qualifying assets above the new threshold.

Government has listened

“Changes to Agricultural Property Relief and Business Property Relief announced in last year’s Budget came as a huge shock to the farming community,” Tom continued. “Until that moment, the best tax planning advice was to hold on to your farm until death and pass it on to the next generation who could continue to run a viable farming, food producing business.

“The original changes to APR and BPR, contained within the Finance Bill, resulted in a pernicious and cruel tax, trapping the most elderly and vulnerable people and their families in the eye of the storm. The NFU and its members have stood strong for what we believed in.

“I am thankful common sense has prevailed and government has listened. I have had two very constructive meetings with Prime Minister Sir Keir Starmer and dozens of conversations with Defra Secretary of State Emma Reynolds. She has played a key role underlining the human impact of this tax.

“These conversations have led to today’s changes which were so desperately needed. From the start the government said it was trying to protect the family farm and the change announced today brings this much closer to reality for many. I’d like to thank the Prime Minister for recognising the policy needed amending and the Chancellor for bringing in the spousal transfer in the Budget. Combined, this is a significant change.”

Announcing the news, Defra Secretary Emma Reynolds said: “Farmers are at the heart of our food security and environmental stewardship, and I am determined to work with them to secure a profitable future for British farming.

“We have listened closely to farmers across the country and we are making changes today to protect more ordinary family farms.” She added that it was “only right that larger estates contribute more”.

Immensely proud

Tom continued: “I am immensely proud of all those farmers and growers who have worked with the NFU and supported our campaign. We have stood together and supported one another when it really mattered. In the end, it was well-reasoned and rational argument that won through.

“I would like to thank all those Labour backbench MPs that were contacted by farmers and growers and decided to stand by their constituents as demonstrated by the recent abstentions on the vote on Budget Resolution 50.”

More than 30 Labour MPs abstained on a vote on Resolution 50 of the Finance Bill which relates specifically to inheritance tax at the start of the month.

“While small in number, it was a significant and brave move for many,” Tom said. “We have spent the past year working with them and there’s no doubt their interventions behind the scenes have also played a huge role in securing today’s news. I would also like to thank all opposition parties for continuously raising the impacts of this proposed policy.”

Thank you to the public

“Finally, I would like to thank the public for supporting our campaign. More than 270,000 people supported our calls for change because they value British food and the working people of the countryside that produce it.

“It has been a very challenging year for many, but I hope we close 2025 with optimism for the future and an ability to work in partnership with all departments across government to see British farming thrive.”