The AHDB Fertiliser Market Outlook covers nitrogen, phosphates and potash supply and demand as well as a global market overview, it seeks to contextualise price movements in order to give readers the knowledge needed to help them make informed decisions when buying farm inputs. The report will be published every two months and explores key global trends and developments in fertiliser markets to inform growers’ and producers’ cost risk management strategies.

The report does not give UK product spot prices or forecast future market prices but AHDB is working on a programme of activity on Inputs Intelligence as part of its Market Intelligence work. A UK fertiliser market spot price tracker is under development to complement the Fertiliser Market Outlook next year.

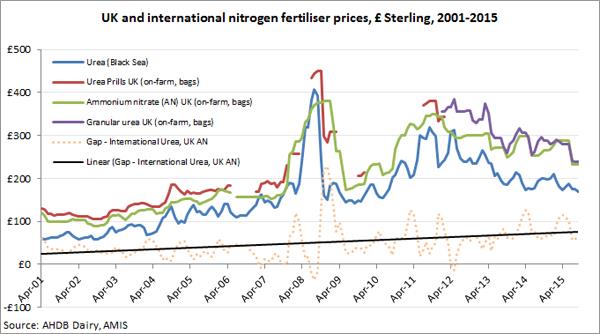

The cost of inputs, particularly fertiliser, is weighing heavily on European grain profitability – particularly in high-input, high output areas like the UK. At current prices and costs many UK arable farmers are producing below the cost of production, and costs for Nitrogen and Phosphate fertiliser in the UK have been rising further and faster than prices on international markets in recent years.

Earlier this year NFU lobbied with Copa-Cogeca for AMIS/FAO to report some basic fertiliser information, this work in analysing the fertiliser market will help to raise awareness of the changing market dynamics and has now been made available (here).

The NFU continues to push for increased market transparency and we have recently written a second letter to the EU Commission seeking removal of import tariffs on phosphate and nitrogen fertilisers. The abolition of such tariffs would help to increase competitiveness within the EU fertiliser market and ensure that EU fertiliser prices reflect wider global trends. The NFU believes that the Commission should use the tools it has available to remove barriers impacting farming at this difficult time