EU market developments

Sugar prices across the EU continue to feel pressure from a combination of good domestic crop prospects and low world prices. Spot prices in Northwest EU have dropped to the low €400s, ex-works and are close to €500, ex-works in the UK.

The good news is that a large proportion of the UK’s 2025/26 crop is thought to have been sold earlier at prices above this level. But whether a market-linked bonus will be paid this year remains in the balance.

The European beet crop continues to look very good. Production looks set to be only slightly lower than consumption. Meanwhile low world sugar prices have meant that, despite falling domestic prices, imports have continued to flow into the EU/UK. With exports looking less attractive for the same reason, the result is that high stocks are expected to be carried into 2026/27.

The situation is causing huge concern across the EU/UK industry and EU beet processors are keen to avoid another year of low prices in 2026/27. In response, processors are renewing their efforts to reduce area across Europe in order to reduce production to a level where duty-free imports are insufficient to meet demand and duty-paying sugar set the price, which would allow EU processors to return to profitability.

With this in mind, a number of announcements have been made. For example:

- Cosun plan to reduce area by 10%.

- Sudzucker has asked its German growers to reduce sugar beet cultivation by 15% or more. Meanwhile its subsidiaries in other parts of the EU (Belgium, France, Poland) have been asked to reduce area by 25%.

View from the UK

In the UK, area is also set to fall again. The contracting period for 2026/27 has now ended. One option under the contract offer was for growers to take a contract holiday, allowing farmers to take a break from growing beet in 2026/27 but not lose their contract tonnage entitlement for subsequent years. The contract holiday, which was capped at 750,000 tonnes of beet, was fully subscribed. This suggests that area is likely to fall by around 10% next year.

These announcements suggest we could be looking at another sizeable reduction in area across Europe, much more than the 3% drop that was being talked about a month ago, and on top of the 9% drop in 2025/26.

If the cuts are implemented and, assuming a return to normal yields next year, this could be enough to push the import requirement up to a level where duty-paying imports are required. But there are many moving parts; it will depend on the size of the area cut and the amount of stock that will be carried into 2026/27, which is not yet known.

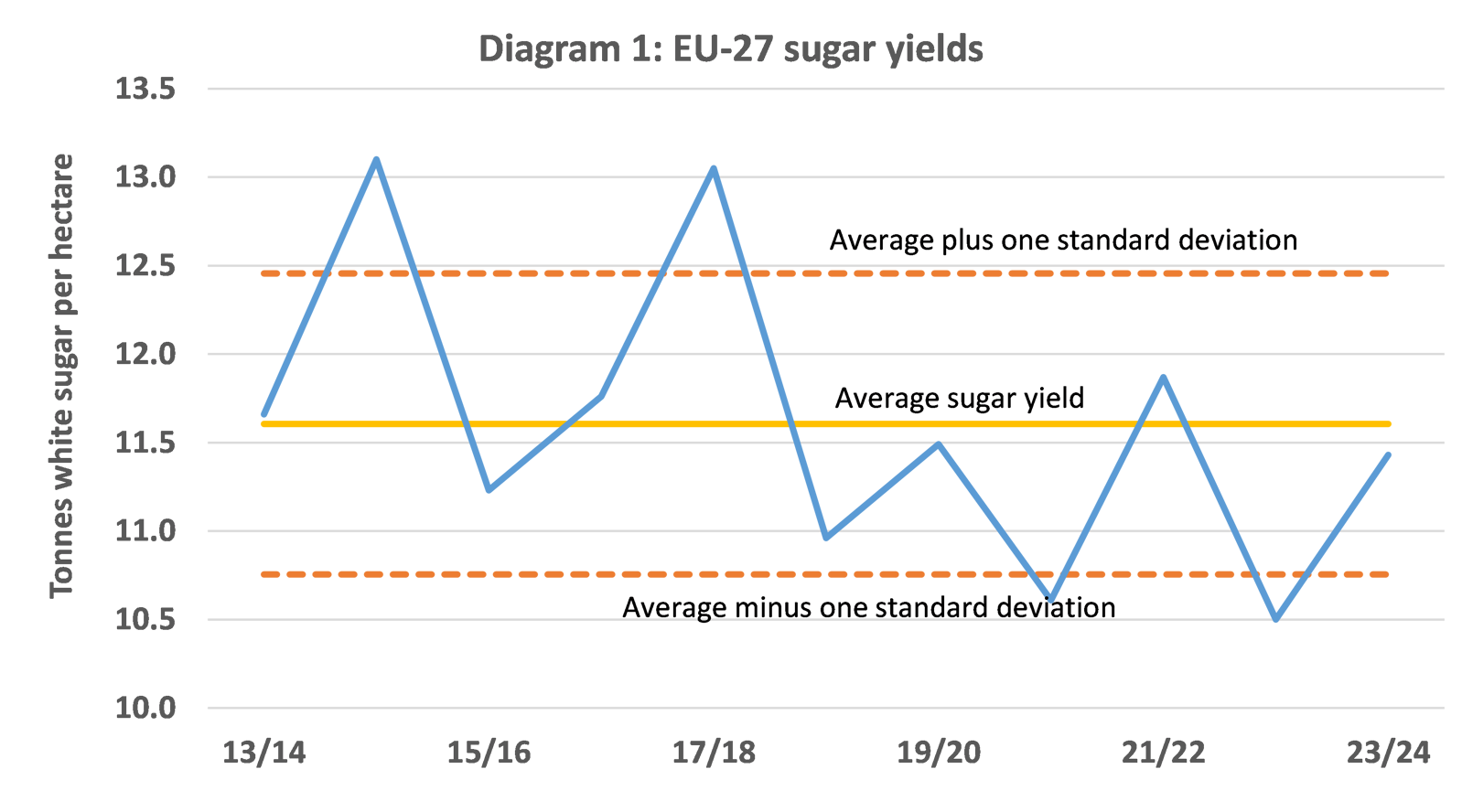

But it is also important to remember that the normal yield variation in Europe is +/- 1.0 tonnes of sugar/hectare either side of the average. If area falls sharply and yields next year are also poor (eg, we suffer a Virus Yellows year), prices could, theoretically, go to a level that reflects the full duty, which is €800/tonne. Given where prices are today, this scenario sounds extreme. But the fact it is a possibility highlights the in-built price instability in the EU market.

Source: CEFS statistics

World market developments

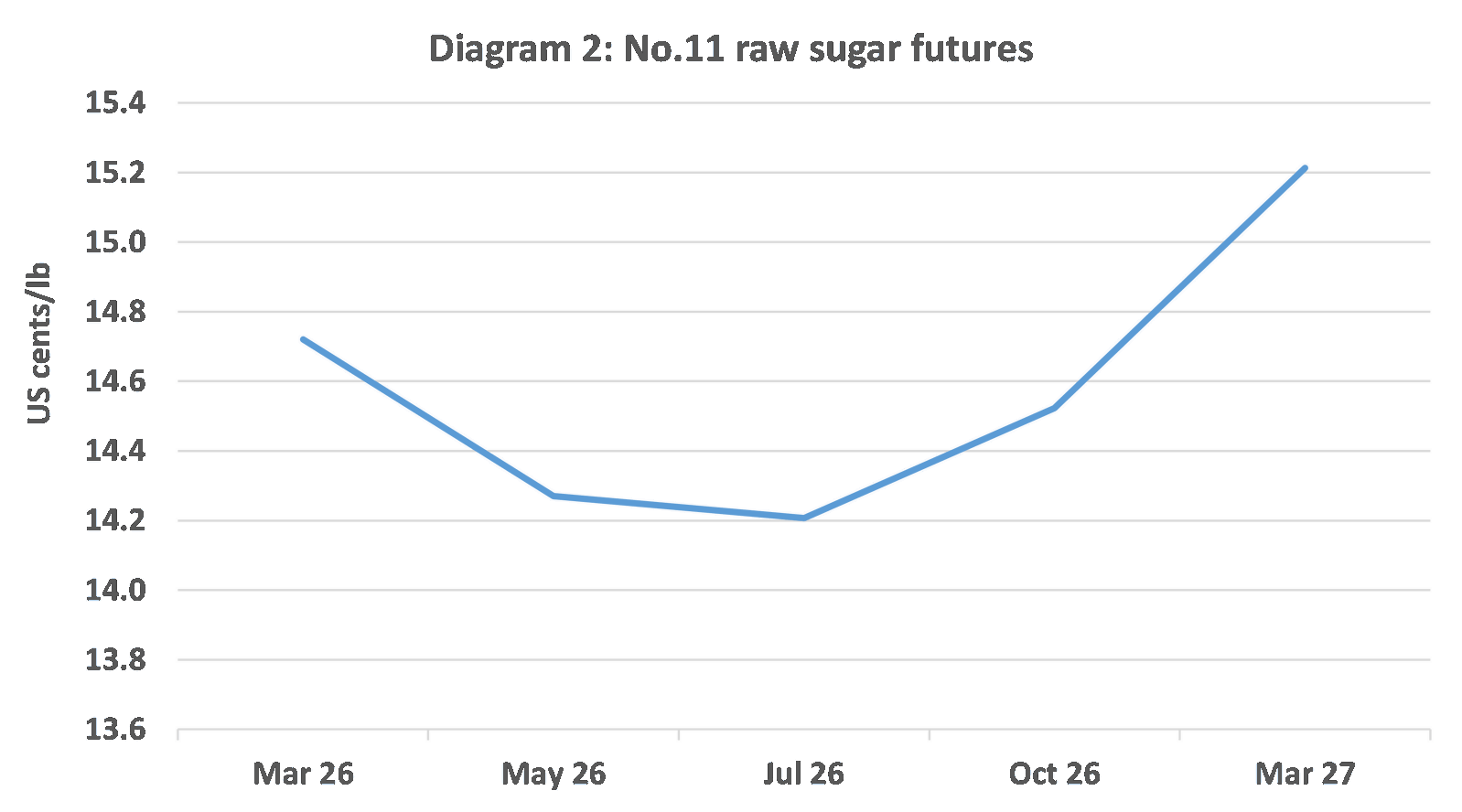

In the world market, No.11 raw prices rose slightly last week but, overall, have remained fairly steady between 14-15 cents/lb over the past month.

The prospect of a faster-than-expected end to this year’s Brazilian harvest helped October 2026 prices to rise to around 14.5 cents/lb at the end of last week. However, the bigger picture outlook continues to be for a reasonably tight balance for raw sugar in Q1 2026, but there is a prospect of a building surplus as Brazil’s 2026 harvest gets going from May 2026 onwards.

Futures prices are trying to resolve this situation with the nearby March price trading at a higher level than prices further forward to encourage import demand to be deferred to a later date when supply is more plentiful (Diagram 2).

This looks to have been made easier by the fact that China, the world’s biggest raw sugar importer, has already imported a lot more sugar than it did at this point last year. Together with the prospect of a good domestic crop this means that it will not need large volumes of raw sugar in the first part of next year.

Note: Average No.11 futures prices on 17-19 November

With the market looking well supplied next year, sugar prices in 2026 remain close to where the Brazilian ethanol price is expected to be in the middle of next year, which is in the region of 14 cents/lb.

Sugar prices are trading at this level to send a signal to Brazilian producers to lower their sugar production next year. As we have discussed in the past, around 2.0-2.5 million tonnes of sugar produced in inland states of Brazil can be lost by the No.11 price moving within 1.5 cents/lb of the ethanol price.

So even though sugar prices are slightly above this reference point, they are still encouraging Brazil to reduce sugar production.

Elsewhere, India has announced an export quota of 1.5 million tonnes. However, for the moment, prices are currently too low for most of this sugar to be exported; but it is more likely to be sold if domestic prices in India fall as domestic stocks build next year.

2026 index-linked price launched

The index-linked beet price for 2026 was launched on 19 November. The opening price was set at £25/tonne, minus service fee, when the No.11 October 2026 futures price was 14.54 cents/lb and the December 2026 £/US$ was 1.31.

While the No.11 Oct 26 price had been lower than this in recent weeks, it still means that a lot of the bearish news discussed above is already priced in.

The question is, can prices rally, or will the current bearish outlook persist and prices go lower? If prices are to rally, even for a brief period, and allow growers to lock in beet prices above the launch price, it looks likely that this will happen in the months prior to May next year when Brazil’s 2026 harvest gets underway. But, as always, there are risks too.

In the coming weeks/months, the points to watch include:

- The US government shutdown means that information about the position held by speculators in the market has not been available. This data is now being published again, but on a delayed basis. If it is significantly different from what the market is expecting, prices could respond in either direction.

- With 2026 prices closely tied to Brazilian ethanol unless the supply situation changes, oil price movements become more important to the sugar market.

- The market is expecting very good crops across the northern hemisphere. We will start to get a better idea of their true size in late January.

In the meantime, upside for prices currently looks to be limited. Low prices mean that Brazilian millers are under-priced for 2026 compared to normal and still have a lot of sugar to sell. If prices rally towards 15.0-15.5 cents/lb (£26-27/tonne beet), the market is likely to run into resistance from significant producer selling.

A trader’s view

NFU Sugar Board appointee and sugar trader Paul Harper shares his thoughts on the current market situation.

NFU Sugar Board appointee Paul Harper

Paul has spent his entire career in commodities and has been in sugar since 1976. He joined C Czarnikow in 1973 working in their London, New York and Singapore offices. Paul has a huge amount of consultancy experience, having consulted for a hedge fund, major bank and a large trade house in sugar during that time.

Little has changed since our last review, with the market continuing to come under selling pressure. New lows encouraged fresh selling from the speculators and, with many traders seeing the expected surplus developing, there is little support to be found even at the lower levels.

European crop prospects continue to improve and Brazil continues to maximise sugar over ethanol, aiding the bearish sentiment weighing heavily on the market.

So far, any attempts at a rally have been quickly halted. Producers and trade appear happy to sell into any strength and without any fresh bullish news it would seem likely that this scenario will continue.

Looking much further forward, some European processors are looking to reduce acreage, and if prices keep falling, other producers might switch to crops other than sugar.

For the time being, however, sentiment remains firmly in the bear camp and the likelihood of lower prices would seem more probable than not.

Policy perspective – PPP emergency authorisation guidance

NFU Sugar is concerned about unintended consequences of recent changes made to the guidance on emergency authorisation of pesticides.

Emergency authorisations are an important part of the UK plant protection regime. NFU Sugar believes the approach towards them must be more straightforward, pragmatic, scientifically robust, risk-based and timely, to ensure consumer safety, and enable UK crop production.