No.11 prices treading water for the moment

Since the launch of the 2026/27 index-linked beet contract in mid-November, beet prices under the scheme have been stuck in a fairly narrow range from a low of £24.04 and a higher of £25.44.

The UK pound has strengthened over the past month – weak economic data from the US has increased the chance of interest rate cuts, weakening the dollar – which has not helped the index-linked beet price. Meanwhile, the October No.11 has been stuck between 14.5-15.0 cents/lb most of the time since the index-linked beet price launched.

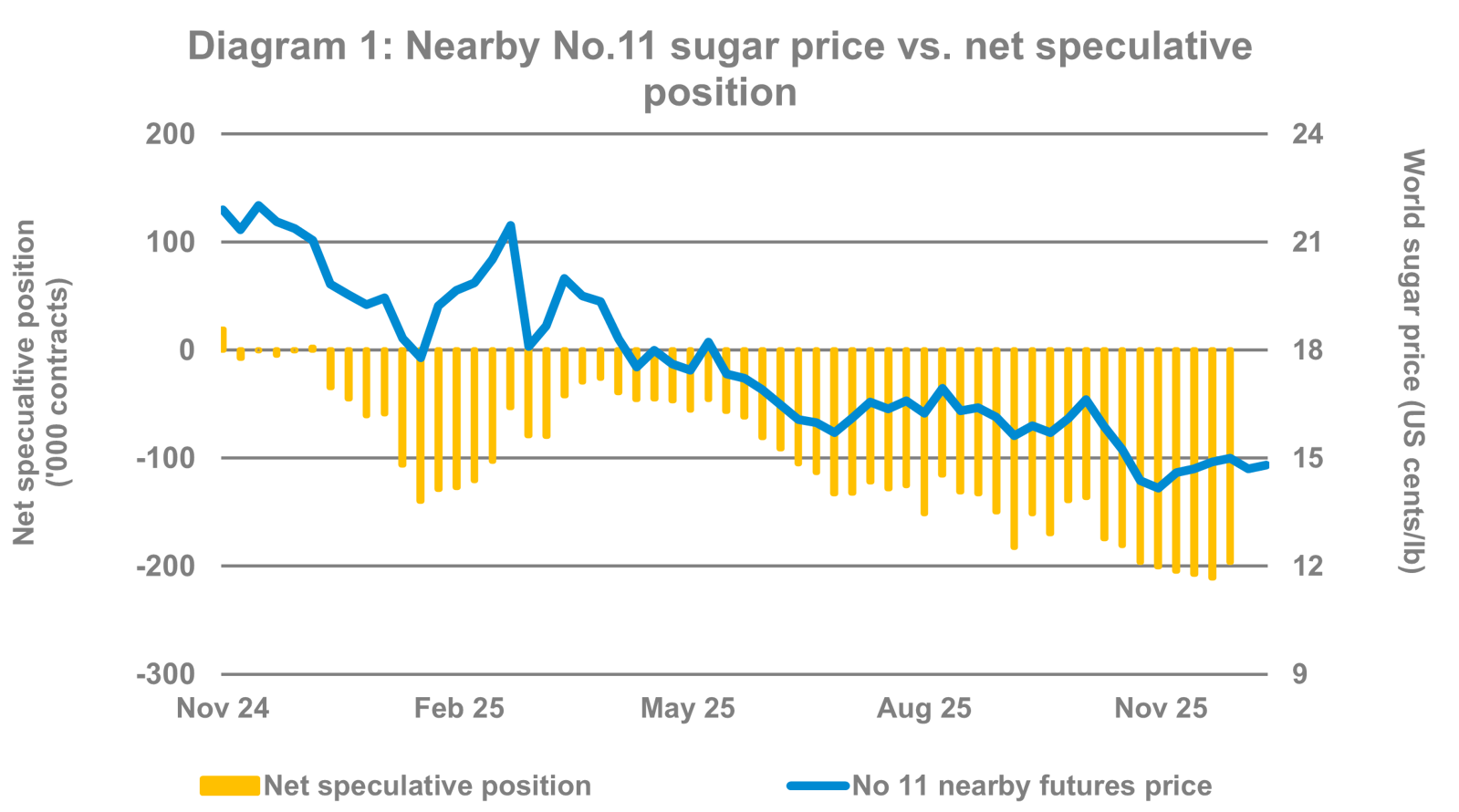

Source: Intercontinental Commodity Exchange; CFTC Commitment of Traders

In production news, Centre/South Brazil’s 2025/26 harvest is approaching its conclusion and sugar production is still on track to exceed 40 million tonnes, in line with expectations.

At the same time, India’s 2025/26 cane harvest is underway and has started quickly; expectations are for a large crop following a good monsoon over the summer. It is therefore likely to have sugar available for export.

Domestic prices are currently too high for large-scale exports to make sense but this could change as the harvest continues and domestic stocks build.

Outlook: Brazilian ethanol is critical for sugar

The market continues to focus on the projected surplus supply when Brazil’s 2026 harvest begins in Q2. Global weather has remained broadly supportive for production. After a drier spell of weather in Brazil, rains have returned, which will help next year’s crop, and long-range forecasts point to broadly normal conditions during Q1, which is a key period for the development of the cane crop.

As we discussed last month, this outlook means that sugar prices in 2026 have been driven down towards the expected price of Brazilian ethanol next year, which most estimate to be in the region of 13.5-14.0 cents/lb. Sugar prices are finding it hard to rally too far away from this because there is a large amount of sugar that would become available at higher price levels.

Brazil has a huge potential switch capacity between sugar and ethanol; sugar production can theoretically swing by a massive 14 million tonnes depending on the relative price of the two products. The current outlook means that if Brazil were to maximise sugar in 2026, the market looks oversupplied. But equally, if prices were to be sustained below ethanol, and millers maximise ethanol throughout the harvest, production would swing away from sugar to such an extent that the market would be undersupplied.

So, the market faces a difficult balancing act.

Prices are trading at a level where Brazilian sugar production in 2026 will be moderated by encouraging some mills to favour ethanol. But it is difficult for prices to move more than a 1-2 cents/lb above ethanol without stimulating additional supply from Brazil and, potentially India, next year.

World oil prices: A key watchout

Because ethanol prices will be important for the market next year, oil price direction is more important for the sugar market than it has been in the past few years. This is because it affects the price of gasoline in Brazil, which in turn, influences the price of ethanol.

Oil prices have been under pressure since OPEC decided to increase output earlier this year and have recently dropped to the mid US$50s/bbl, which is a four-year low. This has created the potential for gasoline prices in Brazil, which are set by the state-owned fuel company, Petrobras, to be lowered. This would push expectations for ethanol prices lower and potentially add more pressure on sugar prices next year.

In this difficult environment, we continue to think that the best opportunities for growers to price their index-linked beet are likely to come before Brazil’s 2026 harvest begins in April. The market balance during this period of the year looks tighter than further ahead and the large short position held by the funds remains a potential source of support (see ‘a trader’s view’ below for further discussion).

But we also have to remember that producers remain under-priced, which will mean they are likely to sell into market rallies above 15 cents/lb (£25/tonne beet at £1.34/US$), meaning rallies during this period are likely to be short-lived. Growers who have tonnage to price on the index-linked contract need to watch closely to take advantage of short-term opportunities that could arise.

A trader’s view

NFU Sugar Board appointee and sugar trader Paul Harper shares his thoughts on the current market situation.

NFU Sugar Board appointee Paul Harper

Paul has spent his entire career in commodities and has been in sugar since 1976. He joined C Czarnikow in 1973 working in their London, New York and Singapore offices. Paul has a huge amount of consultancy experience, having consulted for a hedge fund, major bank and a large trade house in sugar during that time.

Fundamentally little has changed since our last review.

The market began to find some support at the lower levels around 14 cents and with the CFTC Commitment of Traders report showing that the net position held by speculators was more than 11 million tonnes short during November, some of the speculators holding short positions began to buy them back and the market quickly moved back towards 15 cents/lb.

The figures issued by the CFTC are still behind due to the government shutdown in the USA, but it is clear there is a very large position held by speculators who have no facility to deliver physical sugar. This means that further buying back of these short positions could cause prices to rally.

Physical values for raw sugar shipments in the first quarter of 2026 out of Brazil remain firm and there are signs that ethanol production is beginning to increase slightly. Should this continue, it may be the catalyst for additional short covering.

Statistics continue to suggest a surplus for the coming year but, in the short term, the prospects for a rally look possible. If it should occur, it is likely to be short and sharp with the market returning to a more bearish stance as we move towards the 2026/27 Brazilian crop from April onwards.

EU sugar sector lobbies institutions for support

The combination of low world prices and excellent beet sugar yields this year means that EU sugar prices remain under pressure. Spot prices remain very low, at around €400/tonne, ex-works Northwest EU. However, very little sugar is being sold at these prices, with most 2025/26 sugar sold at higher price levels.

The latest reported price by the EC, which reflects the price of sugar despatched in October (the first month of 2025/26) was €531/tonne, ex-works. While UK prices are not reported, ex-works prices normally trade around €50-60/tonne above prices in the EU.

CIBE (the European beet growers association) along with CEFS (the beet processors association) have sent an open letter to European institutions to alert them to the worrying situation in the EU sugar market.

To help the situation, they have requested:

- The immediate suspension of imports made through the IPP (Inward Processing Procedure), which allows sugar to be imported duty-free as long as it is exported in final products later. Imports under IPP have increased sharply this year.

- A structured dialogue with the European Commission and stakeholders to discuss how the market situation could be stabilised.

Given the importance of the EU market to price levels in the UK, we will continue to keep growers updated on developments.

In the meantime, there has been further news pointing to another large reduction in area in 2026/27. Last month, we reported that Cosun (Netherlands) have asked growers to reduce area by 10% and Sudzucker has asked its subsidiary companies in Belgium, France and Poland to reduce by 25%. On top of this, Polski sugar in Poland have reduced their contracted tonnage by 10%. Many other industries are expected to reduce area by a further 3-10%.

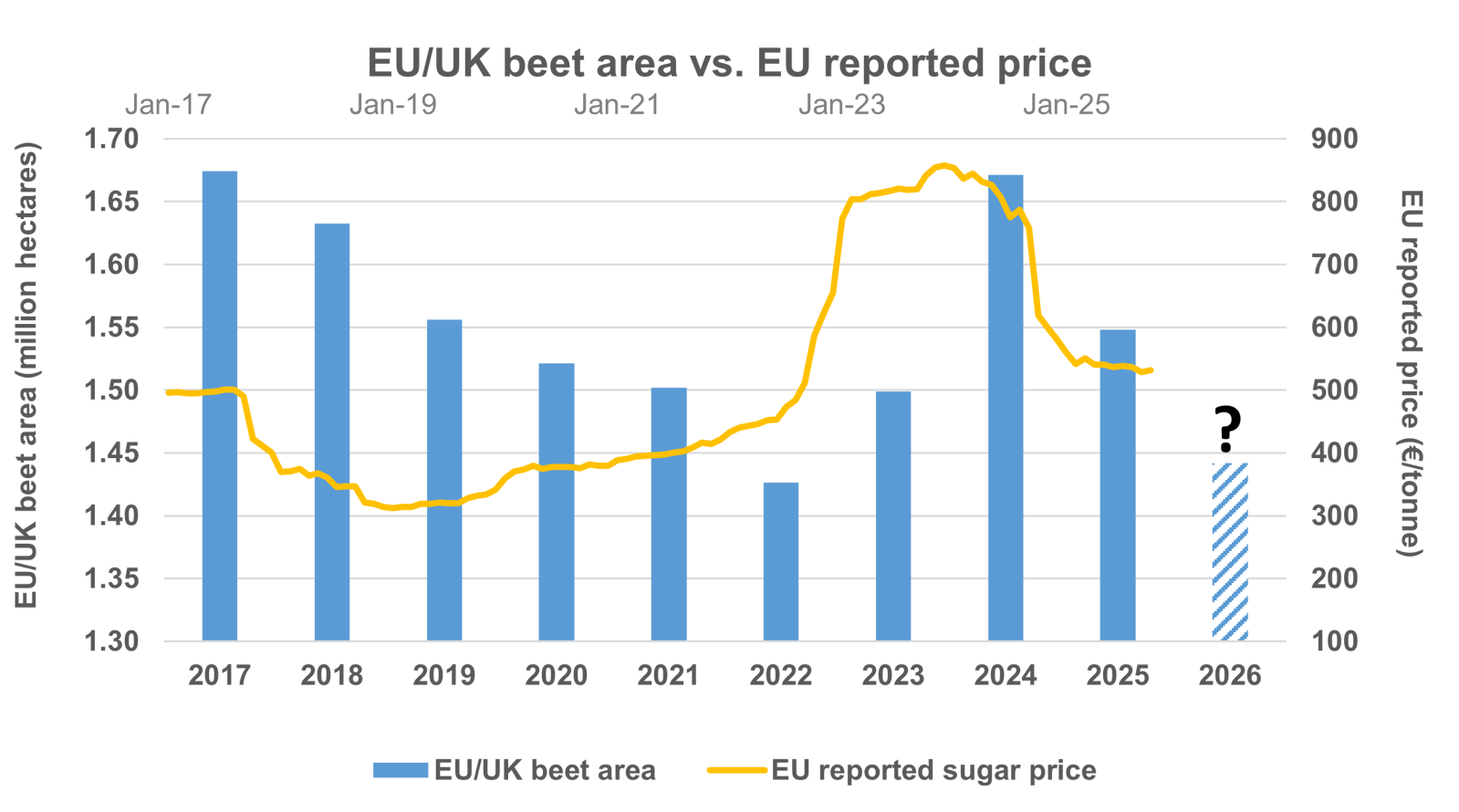

If we see an area reduction of 5-10% overall, it would result in one of the lowest beet areas in the EU/UK since the 2017 reforms. The diagram below shows that the last time that area fell that low, a year of below-average yields resulted in a subsequent price spike. While the EU/UK market looks very well supplied currently, this possibility will be on buyers’ and sellers’ minds next spring particularly if there are question marks about crop prospects.

Source: Source: GlobalData (historical beet area from 2017-2025); European Commission

Policy perspective

NFU Sugar extremely disappointed by expansion of raw cane sugar ATQ

The government has expanded and extended the raw cane sugar ATQ (autonomous tariff quota), up from 260,000 tonnes to 325,000 tonnes of raw cane sugar. This sugar can come from any origin and will be able to enter the UK tariff-free every year through until 2033.

While UK sugar beet growers continue to contend with ever tighter regulation, the ATQ provides tariff-free access for sugar produced anywhere in the world which often derives a competitive advantage from having been produced in ways which simply would not be legal or possible in the UK.

NFU Sugar remains wholly opposed to an ATQ for raw cane sugar of any size. It will continue to challenge government thinking in this area, and advocate instead for a joined-up policy approach and a level-playing field on trade.